I analyzed ALL Marriott luxury properties worldwide - here is what I found…

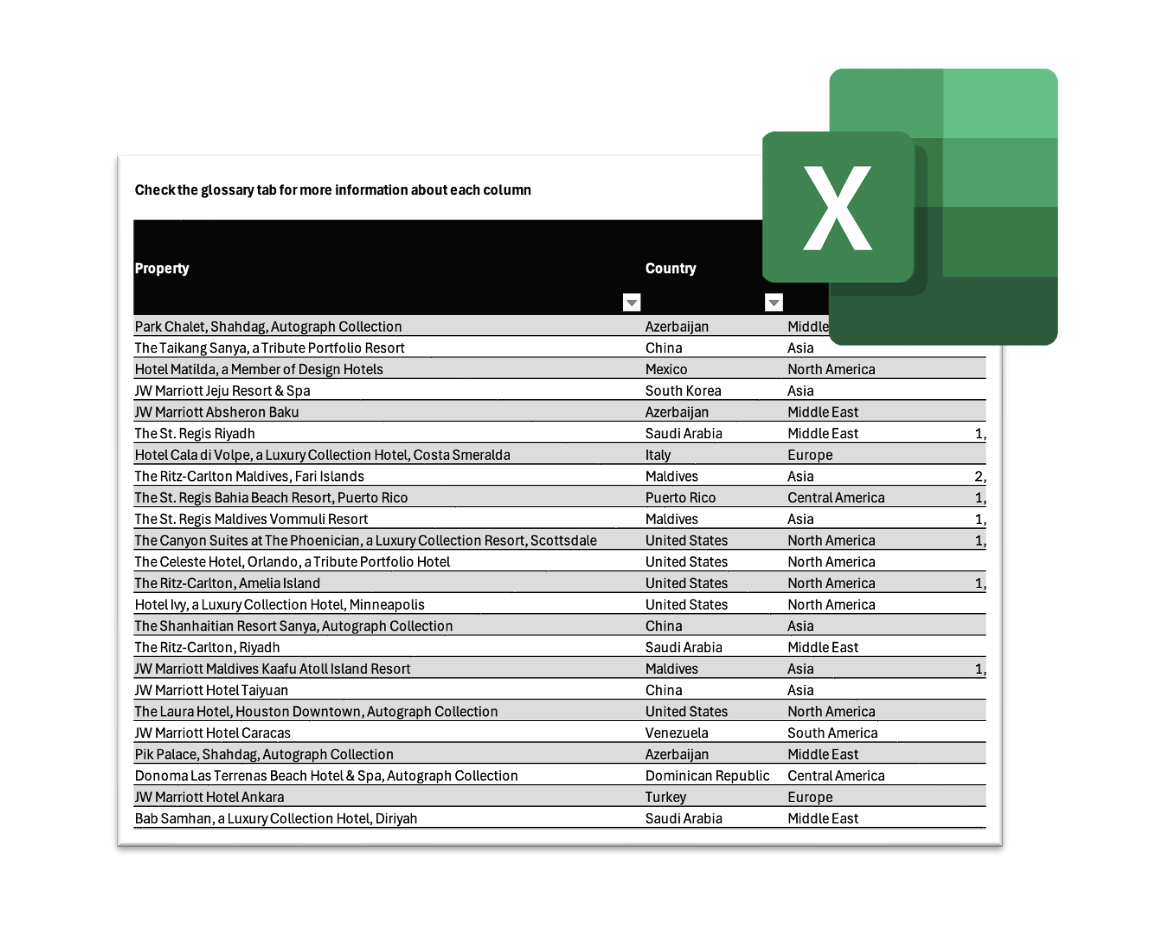

Wow, this has been a ton of work. Over the last days and weeks, I have been diligently gathering data on all luxury Marriott properties in the world, all 1,109 of them, to give you the most advanced insights on pricing and cents-per-points values.

1. Assumptions

But let me start from the beginning. First up, I had to limit the number of properties - while I would love to look at every single Marriott property in the world, it would simply be too many. So I decided on the brands I wanted to look at.

An overview over all the properties taken into consideration for this analysis (Source: Google Maps)

After doing my Hilton CPP analysis a while ago (you can find it here), I noticed a strong correlation between the cash rate of a property and how good of a value it is if you book it with points. With that in mind, and also because I am mostly interested in more high-end properties, I decided to focus on the following brands:

From the Luxury section:

St. Regis

Ritz-Carlton

W Hotels

Luxury Collection

EDITION Hotels

JW Marriott

From the Premium section:

Autograph Collection

Tribute Portfolio

Design Hotels

I figured that this selection should roughly cover most higher-end luxury hotels within the Marriott chain. Of course, there are still some Marriott, Westin, or Sheraton properties that can be quite pricey, but I had to cut down somewhere.

Property distribution by region (Source: Unmatched Voyages)

Furthermore, I had to make assumptions on how many points the average traveler would earn during their Marriott stay and how much they value them. While this is a minor factor in the entire analysis, I wanted to get it right.

Whenever you stay at a hotel and pay a cash rate, you earn Hotel points for each Dollar you spent. The standard rate for higher-end Marriott hotels is 10 points per Dollar. If you hold a loyalty status you get bonus points. I assumed that the average traveler holds a Gold Elite status, which can be easily obtained through a few stays or by holding a Marriott-related credit card. With that status you get 25% bonus points, so for each Dollar you spend you get 12.5 Marriott Bonvoy points.

Each Marriott Bonvoy point must be assigned a value. In my analysis, I assumed a conservative 1.0 cents per point. That is quite a bit over the average CPP in my analysis but fits nicely into my definition of a decent redemption, since you can often buy Marriott Bonvoy points for around 0.80 cents per point (Check the button below to see if Marriott running a points sale with bonus points right now!)

Mind you that those are just my assumptions and there can be made many arguments for or against them. I had to decide on them and figured that this would roughly reflect the average traveler.

2. Taxes and Fees

We have to take taxes and fees into account to reflect the accurate cash prices and make a proper comparison. These are not shown during the overview of hotels for an area and only come into play when you click further into selecting a specific room for the property you are interested in. The difference in price can be negligible (most of Europe mandates taxes and fees to be shown in the advertised price), while in some countries you see an additional 25% - 35% in taxes and fees on top of the advertised rate!

The Westin Maldives Miriandhoo Resort is advertised with a $660/night rate (Source: Marriott)

When you click through to the final price of that cheapest room, the average price has skyrocketed. Granted, $550 of that is a one-time transportation charge. But additionally, you are asked to pay an additional $194 in taxes and fees for every night you stay there (Source: Marriott)

3. Data points

Unlike Hilton, Marriott does not offer an easy view of the total average price for each property. Instead, it only shows a cash and points value when you select a specific date.

Now, we have all seen extremely high hotel prices for very specific dates when there is a big concert or convention in town, or low prices during off-peak season (e.g. during the hot summer in Dubai). Therefore, I tried to average out the values by picking a total of 4 date ranges for each property, each within a different month, and each a 3- or 4-night stay:

Date ranges used in this analysis:

February 4 - 7, 2025

April 19 - 23, 2025

July 30 - August 2, 2025

September 13 - 16, 2025

There are certain limitations with this approach, at least if you are interested in good data quality: Not every property is available to be booked with cash and points for each of these 4 data ranges. Consequently, for some properties I got only three, two, or just one data point.

Use your points to stay at the outstanding Ritz-Carlton Kyoto (Source: Marriott)

To not have outliers skew the outcome of this analysis, I decided that I would drop any property for which I could find less than 3 data points. Especially properties in Azerbaijan seem to score quite highly in CPP but due to the properties not showing availability further out into 2025, I had to exclude them from this analysis (if you are interested, purchase the entire data set which includes also properties with only one and two data points).

4. Considerations

Before we look at a preview of the results, I wanted to bring up a point that someone commented on my last analysis, and that is the matter of fair pricing. We all want to get the best value out of our stays and a higher price often means a better cents-per-point value if you redeem award nights for it.

How about spending your next winter holiday at the St. Regis Aspen Resort? (Source: Marriott)

However, there certainly are properties that do not seem to reflect their true value. I recently stayed at the newly opened THE OSAKA STATION HOTEL, an Autograph Collection in Osaka, Japan. The cash rates were around $800 per night - however, to me the hotel was ‘only’ a beautiful higher-end city hotel and I am not sure if the cash rate really reflects the value (to me). The $800/night price tag puts it close to properties such as the St. Regis Osaka or the Ritz-Carlton Osaka, which are outstanding hotels. I am not sure if the price reflects the ‘true’ value of what you are getting as a guest.

5. Preview of the Results

Of course, the highest CPP is what we are all after, isn’t it? Where do I get the best value when I want to use my hard-earned points? And where should I rather resort to paying in cash? Where in the world can I find the cheapest luxury properties and where will high taxes and fees make my stay a lot less nice?

Here is a little preview of two of the many tables and analyses I have included into my report that is up for purchase below (or you can head to the ‘Shop’ via the top right menu):

Highest Cents-per-point value worldwide - Ranks 30 to 20

List of ranks 30 to 20 of highest CPP properties worldwide (Source: Unmatched Voyages)

In this section, you can see a surprising amount of Autograph Collection. I did not expect this brand to perform as well as it did due to most of its properties being rather on the cheaper side. However, as you can see in this table, average cash rates per night can be in the realms of $500 - 1,000/night for some of the higher-end properties of the Autograph Collection brand.

Highest Cents-per-point value in Europe - Ranks 30 - 20

List of ranks 30 to 20 of highest CPP properties in Europe (Source: Unmatched Voyages)

Europe has a pretty decent variety of hotels and is no stranger to highest-end hotels in Venice, Paris or Rome. Fortunately, the continent also has a lot of hotels with a strong CPP value to offer - properties, where using your Marriott Bonvoy points will on average yield discounts of 50%. However, seeing the rather low CPP for ranks 20 - 30, you can tell that the number of properties where points redemptions are a great deal most of the time are few.

Cheapest luxury Marriott properties in Africa and the Middle East

Cheapest Marriott luxury properties in Africa & the Middle East (Source: Unmatched Voyages)

As you can see, there are some impressively inexpensive luxury properties available in the region. While you won’t find a Ritz-Carlton or St. Regis at this price point quite yet, there are a ton of luxury hotels that you can stay at without breaking the bank. As you can see from the CPP column on the right, neither of these properties should be booked with points (at least not on average - it is always good to check cash rates and point rates for your specific property and date range, as these values can vary widely).

Is there a correlation between cash price and CPP?

Scatterplot of all analyzed properties mapped by cash rate and CPP (Source: Unmatched Voyages)

We saw in the Hilton CPP analysis that there is a strong correlation between the cash price and the CPP, meaning that on average the pricier a hotel is, the more attractive it is to use Hilton Honors points. With Marriott, as you can see in the chart above, there is a trend but it seems to be less strongly correlated.

While on average, the pricier hotels are the ones that you would want to spend your points on, there are much more exceptions to this rule.

6. How can I get the full report and why did you hide it behind a paywall?

I love gathering and analyzing data. I work in Finance and most of my work is filled with data analyses and there is nothing that makes me happier than using these skills and apply them to my favorite hobby - traveling!

The feeling of staying at hotels at huge discounts due to the smart usage of points is just the best.

And while I love to share and give back to the community with my articles, I also am hoping that I can turn this into a more permanent and sustainable work. Right now, I am spending most of my free time gathering data and building Excel sheets and tables. While this is something I do enjoy, it would be great if I can get something out of it for the time I invested.

I do not want to get rich of this or even expect to make the money back that I am putting into this website, but it’s nice to feel that my work is being valued. Therefore, while yes, the full 30-page report and the full Excel data set are not free, I put a very low price which I’d argue anyone who is interested in this type of traveling can afford. So if that sounds good to know, have a look at the preview of the two products below (or via the ‘shop’ button on the top right of the menu):

Marriott International has celebrated a new milestone in Southeast Asia: on September 15, 2025, the JW Marriott Cam Ranh Bay Resort & Spa officially opened its doors, marking the debut of the JW Marriott brand in Vietnam’s wellness hub of Cam Ranh…